Finding Largest File in Google Drive

February 27, 2020

Merging PDFs with PDF Sam

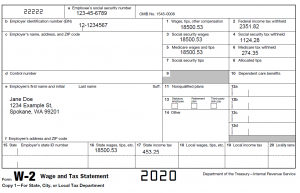

February 29, 2020Tax season is finally here! For many, such as small businesses or first-time filers, this is a period that they dread. Why? Because of the complexities and many questions that arise during the filing process. However, if you are an employee with a 9-to-5 job, income tax filing take a lot less effort to complete than someone who has a small business or has multiple streams of income. Because of this, today's post will focus on the most important document you will need to file your taxes: the W-2.

What is W2?

As stated above, the W2 is a very important document that is needed in order to file your taxes. The role of the W2 form is to provide a summary of the following:

- Provide exact amounts of how much income, social security, or Medicare tax was withheld throughout the entire calendar year

- The amount of income tax that would have been withheld if the employee had claimed no more than one withholding allowance

As you can tell, this document is there to let the IRS determine if you paid your fair share of taxes, paid more than your fair share or not enough. By looking at this form, one can simply determine how much more, if any, tax needs to be paid. Below is an example:

Now that you have an idea of what this form is, just be on the lookout for it as it will be sent to you by your employer via mail. Once you receive it, make sure you do not dispose of it as this will be needed by your tax preparer to file your taxes. For more information on this form, visit the official IRS website at www.irs.gov.