PDF Sam Basic

March 17, 2020

GIMP

May 21, 2020As a tax preparer, one of the most common questions that I get asked a lot about is what are tax brackets. Many believe that tax brackets refers to the percentage that their income will be taxed on. Even though this is partially true, it is not correct. Therefore, in this post I will explain what the 2020 tax brackets are and how they work.

What are they?

To put it simply, tax brackets are percentage rates used to determine how much tax an individual or couple will have to pay on the money they earn. Please be aware, that the tax bracket a person may fall under is heavily dependent on how much actual income they keep after all allowed deductions have been taken into consideration. So even if it seems like you may be within a high tax bracket, after your deductions are used, you may actually be in a lower tax bracket and thus, owe less tax.

Year 2020 tax brackets

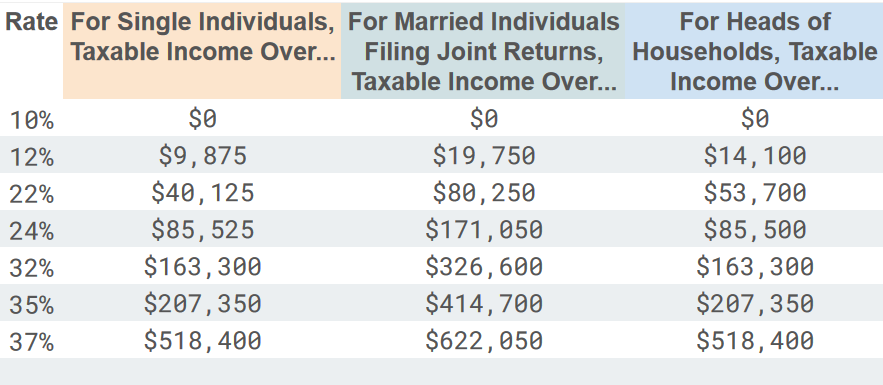

Below are the tax brackets for the 2020 calendar year.

Source: Internal Revenue Service

How to read the table

Looking above, you may be asking yourself how to read the table above. The way you do it is by starting with the header titles and see which filing status you fall under. When the IRS says "filing status", they are referring to the "legal relationship status" that you would fall under. For example, if you are not married and have no kids, you will be under the column that reads "For single individuals". If you are legally married, then you will be under the column to the right of that title "For Married Individuals". And lastly, if you have a dependent such as a child or are the only one working, then you are under the column "Head of Households."

Once you determine your "filing status," you will then look at the rates. If you look closely, you will notice that there are 7 different rates that start at 10% and go all the way up to 37%.

How does it work?

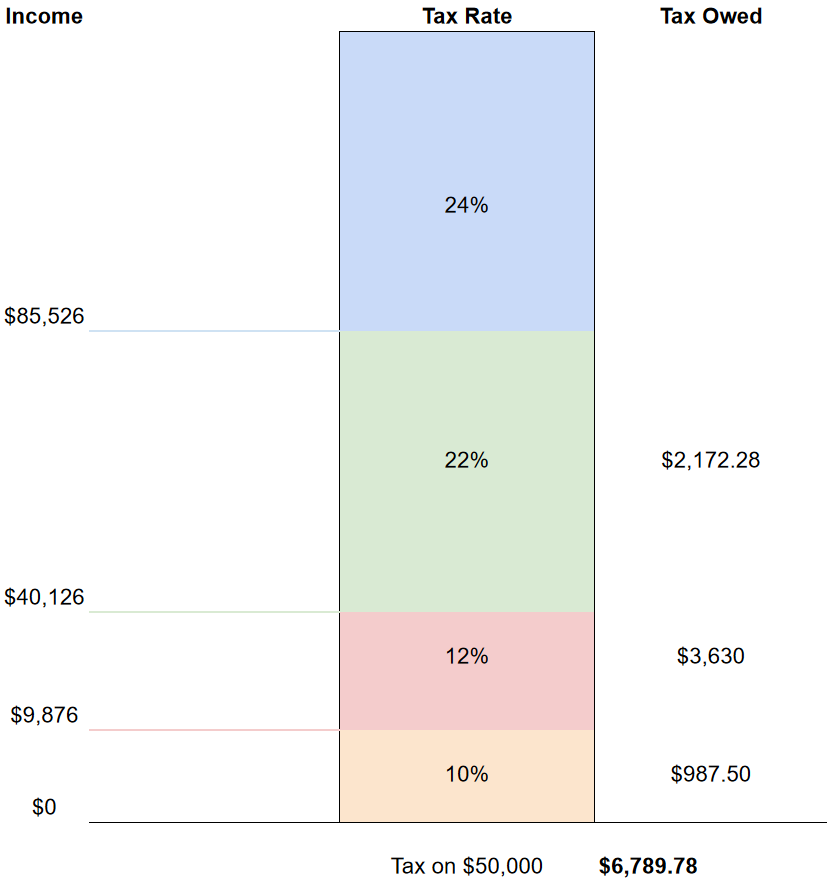

The tax brackets are very simple once you understand them. The first thing to remember is that that tax bracket you fall under does NOT mean that you will pay that percentage for every dollar. For example, if you earn $50,000, you will NOT pay 24% ($12,000). The way it works is that tax rates are there to determine what is the tax percentage you will owe for every dollar after each threshold within each tax rate is reached.

For example, lets use the same $50,000 mentioned above. The actual tax amount that you will owe is actually divided into sections. As we see in the table, anything from $0 up to $9,875 is taxed at 10%. This means that out of that $50,000 only $9,875 will be taxed at 10% ($987.50). After that, the amounts from $9,876 to $40,125 ($30,250) will be taxed at 12% ($3,630). Lastly, the amounts from $40,126 to $50,000 ($9,874) will be taxed at 22% ($2,172.28). Finally you total them to find out that you will owe a tax of $987.5+$3,630+$2,172.28 = $6,789.78. If we compare that to our initial guess of $12,200, this new amount is lower by a total of $5,410.22!!

As you can see, understanding the tax rate will give you a better idea of the actual amount you will owe in taxes on $50,000 of net income.